On April 16,

James

McAndrews, Executive Vice President and Director of Research at the

Federal Reserve Bank of New York gave a

speech to the press about the effect of increasing balances of student loan debt on the country. The slides from the press briefing are available

here if you missed it.

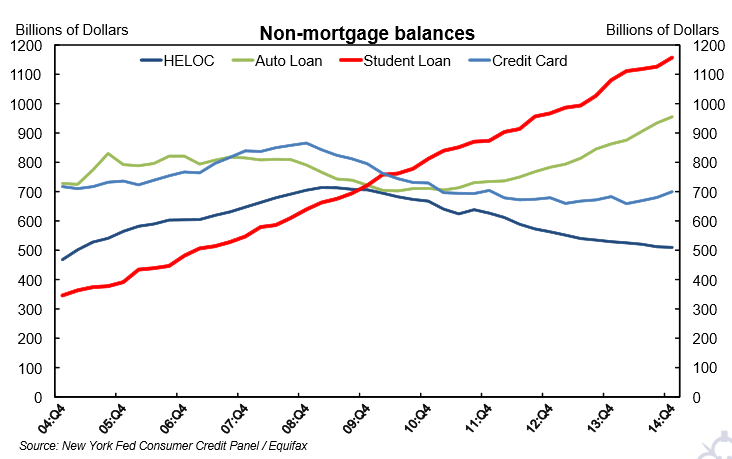

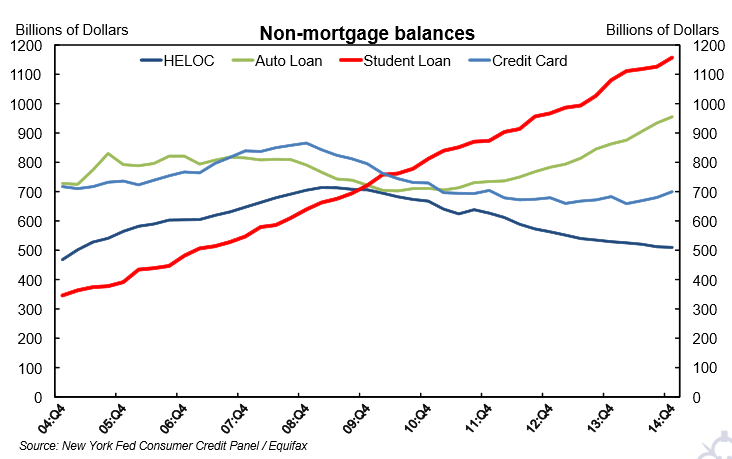

According to McAndrews, and no surprise to most, student loan balances have increased steadily over time as you can see from the chart below. This is contrary to most other types of non-mortgage balances.

|

| Source: Student Loan Borrowing and Repayment Trends FRB Presentation |

The rate of growth is even more pronounced for older borrowers.

The fastest growth was in balances held by those over the age of 60. Between 2004 and 2014 the average balance held by borrowers 60 years and older increased 850 percent. The percent of student debt held by borrowers over the age of forty climbed from 25 percent to 35 percent over the same time period; that's nearly double the pace of younger borrowers.

According to the article,

the sharpest area of growth was from the

lowest income areas of the country. The authors also found that the

number of people defaulting on their loan increased significantly from

2011 to 2012, but has declined over the past two years.

In addition, the authors found that the

default rates were highest for borrowers in their thirties. These were, coincidentally, also the borrowers with the highest balances.

|

| Source: Student Loan Borrowing and Repayment Trends FRB Presentation |

While the total number of student loans has increased, the number of

new students taking on loan debt is decreasing. The obvious question: why are balances increasing when there's a decreasing number of new borrowers -- low repayment rates. Repayment rates are very low resulting in borrowers with higher balances.

It is not unusual for borrowers to have lower balances when they leave school than they do five years later.

Much of the information about income comes from an article released after the press release by the research leg of the NY FRB entitled

Just Released: Press Briefing on Student Loan Borrowing and Repayment Trends, 2015.

|

| Source: Student Loan Borrowing and Repayment Trends FRB Presentation |

Default rates are highly correlated with

income; the more income people make, the more likely they are to pay off

their student loan. Default

rates for borrowers from the lowest-income areas are almost three

times those of borrowers from areas with the highest average income. Not surprisingly, lower income groups have made practically no progress

in paying down their loans over the past 5 years. This is in contrast to

borrowers in the wealthiest areas that have paid down balances by 30

percent.

In conclusion, these are the five most salient points from the presentation:

- There's been a slowdown in new student loans and default rates over the past two years.

- Total loan growth is continuing to rise.

- The driver of the growth is low repayment accounts and high delinquency rates.

- Borrowers over 60 lead the way in loan growth, but default rates are highest for borrowers in their thirties.

- The increase in payment difficulty comes from lower and middle income areas.

7 years later and we're still feeling the pain caused by the Great Recession. As people got laid off, they took advantage of student loans and returned to school. Many didn't finish school. Many didn't find jobs. Those that did, found wages to be too low to make payments on the loan. It seems that only a lucky few have been able to turn an education into a higher quality of life.

Student loans aren't just an issue for young people, they've become an epidemic for the entire nation. The next step is figuring out what we can

all do about it.

One thing you can do: add to the conversation by posting a comment to the

comment feed for the FRB article.