Important: There is no guarantee that our strategies will have the same performance in the future. We use backtests to compare historical strategy performance. Backtests are based on historical data, not real-time data so the results we share are hypothetical, not real. There are no guarantees that this performance will continue in the future. Trading is extremely risky. If you trade futures live, be prepared to lose your entire account. We recommend using our strategies in simulated trading until you/we find the holy grail of trade strategy.

We haven’t found the holy grail of automated trade strategy yet, but we get closer with every strategy. Click here for the most recent performance chart and links to all strategy descriptions.

While our focus is primarily on futures, I wanted to take a moment to answer a question that I get at least once a week: Do your strategies work on stocks?

Personally, I invest in stocks and crypto, and trade futures. In other words, I buy and hold stocks/crypto and day trade futures, primarily equity futures.

Why do I prefer trading futures?

Futures are highly liquid, which increases price action. Margin requirements are also fairly low compared to the assets you have control over, which means you have considerable leverage. Short selling is much easier in futures and you can trade 23 hours a day, six days a week. Last but not least, from a tax perspective, capital gains follow the 60/40 rule and there is no wash sale rule—all your trades are combined and you either make a gain or loss at the end of the year.

So why are we looking at stocks?

Aside from the fact that a backtest using stocks is a common request, there are more stocks than futures, which means there are more markets to choose from. That also means there’s more opportunity to find a stock that works well with a particular strategy. In general, we use 10-15 different futures contracts, but there are over 3,000 stocks listed on the NASDAQ alone. Each one of those stocks has a defined market.

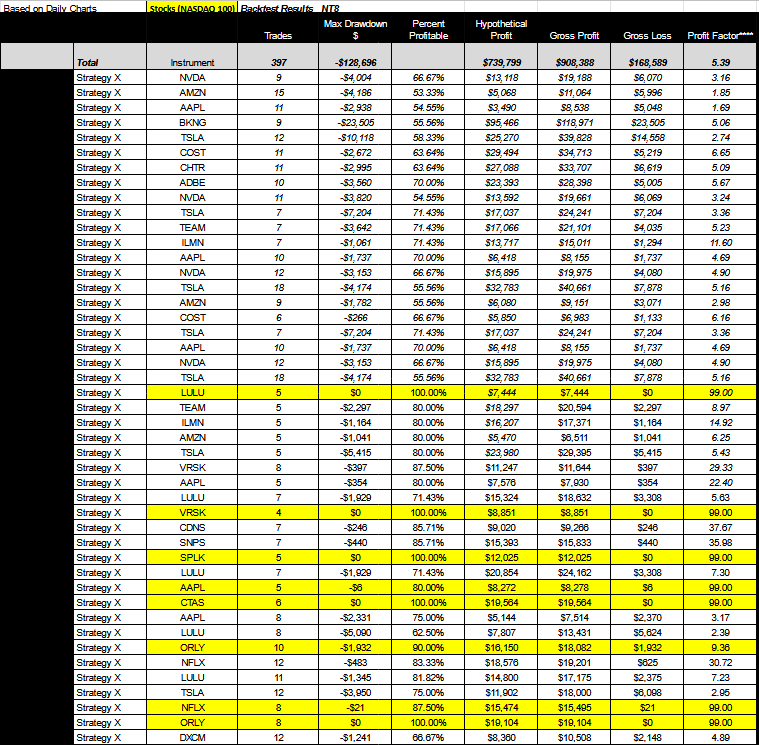

A semi-exhaustive experiment would include running all 62 of our strategies against all 3,000+ stocks on the NASDAQ to see which ones have the best performance (win rate > 90%, profit factor > 5, and trade count of 5 or more). That would take a lot of time, so we’re just going to look at the stocks that make up the NASDAQ-100.

Stock Performance

I started off by looking at just five stocks to see which strategies performed well. Then I ran the strategies that performed the best on all 100 stocks in the NASDAQ-100. The following results are a sample of those results.

The backtest is based on trading 100 shares of each stock from February 1, 2022 to February 1, 2023 using a daily bar chart:

Subscribers, go to original post and scroll to the bottom for a chart that includes Strategy #’s and parameters.

I’ve highlighted some of the stocks with more noteworthy performance. LULU, VRSK, SPLK, AAPL, CTAS, ORLY and TSLA performed particularly well (win rate > 90%) with certain strategies.

Again, this is the first time we’ve looked at stocks. We’ll be looking at more stocks over the next month or so with the hope of adding a few to the forward test.

If you have any questions please contact me at:

AutomatedTradingStrategies@protonmail.com

ATS does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.