- Bitcoin's utility over gold has returned as fake gold bars have entered the market.

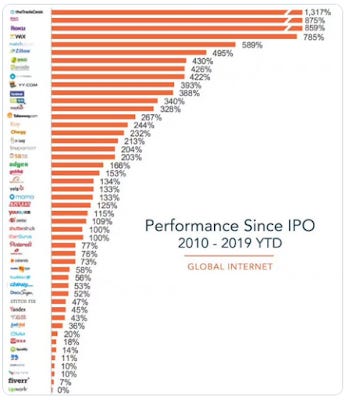

- Data shows bitcoin’s performance has outstripped mainstream investments in internet firms since 2010 by 338,433,233%.

- In Hong Kong, bitcoin is selling at a premium due to mass protests.

Bitcoin's utility over gold has returned as fake gold bars have entered the market.

One day back in 2017, someone noticed that two gold bars had the same ID number. Ooops. A Reuters

report on Aug. 28 said that nearly 1,000 fake bars were found in the

vaults of JPMorgan Chase & Co., one of the major banks at the heart

of the market in bullion.

"The forgeries are sophisticated,"

said the head of Switzerland’s biggest refinery, according to the

article, "so thousands more may have gone undetected".

“The latest fake bars ... are highly professionally done,” said Michael Mesaric, the chief executive of refinery Valcambi.

As fake gold bars are being discovered all over the world, the price

of gold has actually spiked due to asset quality concerns. Everything

is overpriced and central banks are charging investors to

deposit funds (negative rates). This is actually fueling more

aggressive/risky investing and smart investors are looking for safe

alternative investment opportunities like gold, real estate and

bitcoin. The same reasons that are driving people to bitcoin are

driving them to gold, but gold is flawed for two reasons: 1) it is

heavy and 2) it can be faked.

Would you accept gold from

someone you don't trust without verifying its authenticity? I like

gold, but bitcoin requires no trust. The trust is built into the underlying technology.

Bitcoin’s performance has outstripped mainstream investments

It's not surprising that according to the CEO of blockchain-focused

magazine Block Journal, bitcoin’s performance has outstripped

mainstream investments in internet firms since 2010 by 338,433,233%

based on the following data:

That's a lot of alpha. The price went from just a few cents to thousands of dollars over a 10-year period.

In some places like Hong Kong, bitcoin is even selling at a premium (several hundred dollars).

Why is bitcoin selling for a premium in Hong Kong?

The pro-democracy, anti-government protest movement in Hong-Kong is

spurring wider adoption of cryptocurrencies like bitcoin.

Yahoo! Finance reported

that the political upheaval in the city "has made local businesses and

individuals switch to using non-sovereign and decentralized currency."

Hong Kong department store Pricerite announced that it would begin accepting bitcoin, litecoin and ether. Genesis Block has been operating 14 crypto ATMs across the city.

That's not all. Earlier this month, protestors initiated an action to withdraw

as much money as possible from their bank accounts. The goal: protect

personal assets and send a warning to Chinese authorities. It has also

been reported that a number of wealthy individuals ($100 million +)

have begun moving wealth offshore.

This is happening all over

the world and there's a common theme here. Bitcoin and democracy are

linked because bitcoin is a democratized form of money, whereas fiat

(like the dollar) is a centralized or authoritarian form of money. I

talk about this link in the post: Bitcoin & America Have Common Goals: They Are Linked By The Ideal of Democracy.

My spouse and I stumbled over here different website and thought I might as well

ReplyDeletecheck things out. I like what I see so i am just following you.

Look forward to checking out your web page again.

Nothing like a good stumble;)

ReplyDeleteThanks!

Profitable trading actually lies in the space of profoundly talented and experienced dealers. I'm ignorant about any progressive new trading strategies that have significantly worked on the pace of outcome in trading, remembering the latest flaw for trading advertising: the trading robot. https://bestearobots.com/

ReplyDelete