|

| Oil painting (c. 1625) by Peter Paul Rubens of the goddess Thetis dipping her son Achilles in the River Styx. She dipped all of him but his heel. In the myths surrounding the Trojan war, Achilles was said to have died from a wound to his heel, which was his only vulnerability. |

This is a follow up post for the weekly series dedicated to tracking our automated strategies at the weekly level. You can read the first post here. You can also click here for links to all weekly reports so far. The original post provides an overview of our approach/intent along with an explanation of the reporting structure. Just like our annual backtest updates that happen every two months, we’re looking for consistency here, but at a more granular level.

The goal of the series is two fold:

to compare against annual statistics

to develop a rubric for a weekly strategy selection process

The latter is based on the premise that the holy grail of automated trade strategy may not be static, but more fluid like a chameleon or rather made up of multiple strategies.

In this post, we’re going to take some time to document our analysis of the first 8 weeks of the Mudder Report — what went well, what didn’t and why? Most importantly, what is the best approach going forward?

Where Are We Now

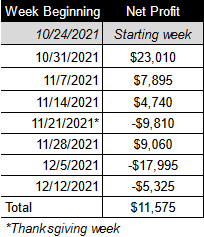

We started this series in the week beginning 10/24/2021. In total, we’ve made $11,575 based on our selection process. Here’s a quick overview of where we are so far:

So, we’re not in the hole, but we had some bad weeks. And, this happened after tightening our criteria for selection after a bad hit in Week 7. These things happen, but now we need to hold ourselves accountable by answering a few questions:

What if we only made a selection based on the number of profitable weeks?

What if we only made a selection based on profit factor?

What if we focused on the direction or strength of the trend (increasing or decreasing) instead of just the number of profitable weeks or the profit factor?

Are certain weeks (i.e., last trading week in December) inherently better or worse for all strategies?

And, perhaps the most obvious question, what if we just go back to our original selection criteria?

To read the rest of this post on Automated Trading Strategies, click here.

No comments:

Post a Comment